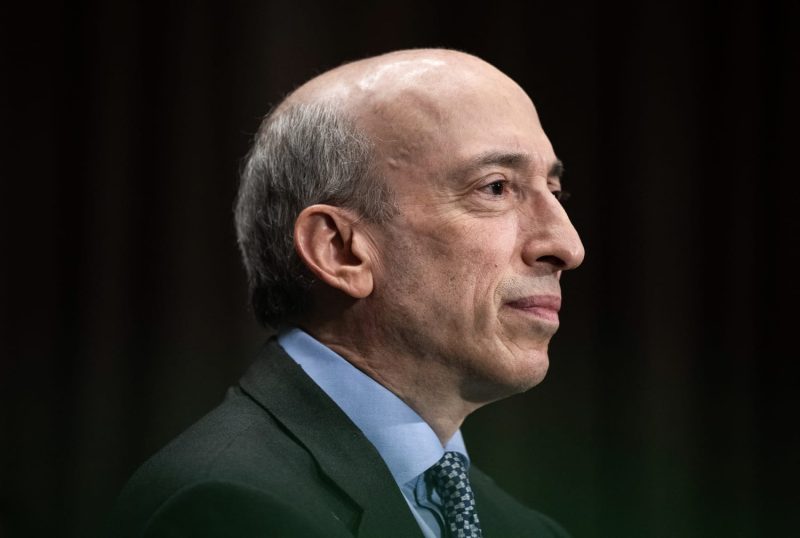

In a surprising turn of events, SEC Chair Gary Gensler has announced his decision to step down on January 20, paving the way for a potential replacement under the Trump administration. Gensler, who has been at the helm of the Securities and Exchange Commission since 2021, has been a strong advocate for investor protection and market transparency during his tenure.

Under Gensler’s leadership, the SEC has made significant strides in enhancing regulatory oversight of the financial markets and fostering greater accountability among market participants. Gensler’s proactive approach to regulating digital assets and cryptocurrencies has been particularly notable, as he sought to bring clarity and consistency to this rapidly evolving sector.

However, Gensler’s tenure has not been without controversy. Critics have accused him of overreach and excessive regulation, arguing that his policies have stifled innovation and hampered market efficiency. In particular, Gensler’s aggressive stance on issues such as payment for order flow and SPACs has faced pushback from industry stakeholders who view his approach as overly restrictive.

As Gensler prepares to depart, the question remains as to who will succeed him as SEC Chair. With the possibility of a Trump administration appointee taking the reins, the direction of the SEC’s regulatory agenda could undergo a significant shift. A new chair under the Trump administration may prioritize deregulation and a more business-friendly approach, which could impact the SEC’s enforcement priorities and policy initiatives in the years to come.

In conclusion, Gary Gensler’s impending departure from the SEC marks the end of a tenure characterized by ambitious regulatory reforms and a strong commitment to investor protection. As the SEC prepares for a leadership transition, the choice of Gensler’s successor will have far-reaching implications for the future direction of financial regulation in the United States. Only time will tell how the SEC’s regulatory agenda will evolve under new leadership and what impact it will have on market participants and investors alike.