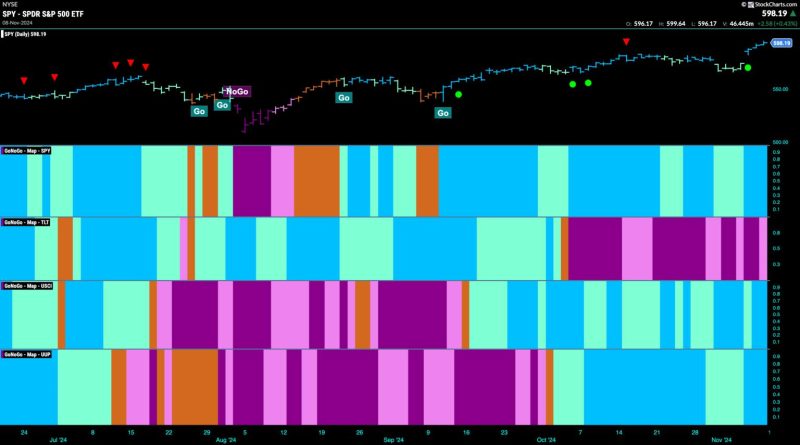

Equity Go Trend Sees Surge in Strength as Financials Drive Price Higher

In the world of finance, trends can be powerful indicators of future movements. The Equity Go trend, a popular stock market trend analysis tool, has recently seen a surge in strength as financials drive prices higher. This surge has caught the attention of investors and analysts alike, prompting discussions about the implications of this trend for the stock market as a whole.

The Equity Go trend analysis tool utilizes complex algorithms and data analysis techniques to identify patterns and trends in the stock market. By analyzing a wide range of financial data, including historical prices, trading volumes, and market sentiment, Equity Go can provide valuable insights into potential market movements.

One key factor driving the recent surge in strength of the Equity Go trend is the strong performance of financial stocks. Financial companies have been reporting solid earnings results and positive outlooks, which has led to increased investor confidence in the sector. This confidence has translated into higher stock prices for financial companies, boosting the overall performance of the Equity Go trend.

In addition to the strength of financial stocks, other factors have also contributed to the surge in the Equity Go trend. Positive economic indicators, such as strong job growth and rising consumer confidence, have helped to bolster investor sentiment and drive stock prices higher across various sectors.

Moreover, the Federal Reserve’s monetary policy has played a significant role in supporting the Equity Go trend. The Fed’s decision to keep interest rates low and provide economic stimulus has created a favorable environment for stock market growth, further fueling the strength of the trend.

As the Equity Go trend continues to gain momentum, investors are closely monitoring its movements and looking for opportunities to capitalize on potential market trends. By using advanced trend analysis tools like Equity Go, investors can gain valuable insights into market dynamics and make more informed investment decisions.

Overall, the surge in strength of the Equity Go trend driven by financials is a reflection of the current market environment characterized by strong performance in key sectors, positive economic indicators, and supportive monetary policies. While future market movements are inherently unpredictable, investors can use tools like the Equity Go trend analysis to navigate the complexities of the stock market and identify potential opportunities for profit.