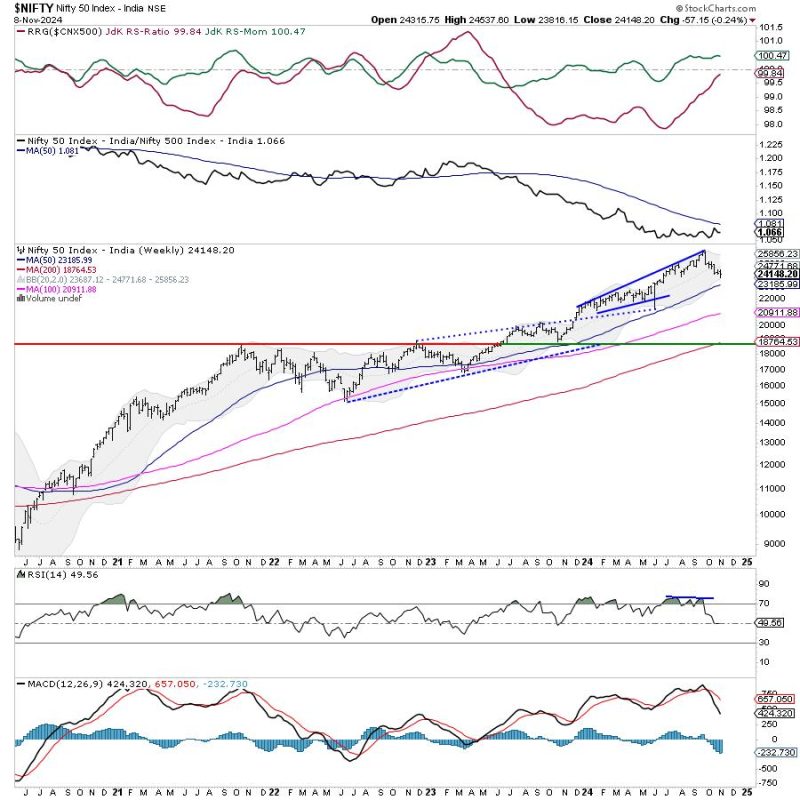

The week ahead brings a sense of caution for traders and investors eyeing the Nifty index, as multiple resistances are anticipated to impede any potential bullish momentum. Technical analysis suggests that the Nifty is likely to remain sluggish and struggle to break through key resistance levels. Traders should tread cautiously and be prepared for increased volatility as the index navigates these hurdles.

One of the critical factors contributing to the anticipated sluggishness is the presence of multiple resistance levels clustered in a specific zone. These resistance levels act as psychological barriers for market participants and often prompt profit-taking among traders. The Nifty’s inability to breach these resistance levels may lead to a consolidation phase or even a pullback in the near term.

Furthermore, market sentiment remains sensitive to global cues and macroeconomic fundamentals. Uncertainties surrounding geopolitical tensions, trade relations, and economic indicators can sway investor sentiment and trigger volatility in the market. Traders should remain vigilant and stay updated on external factors that could influence market dynamics.

Technical indicators also provide insights into the Nifty’s potential trajectory in the upcoming week. Moving averages, trend lines, and chart patterns offer valuable signals that traders can leverage to make informed decisions. However, it is crucial to exercise caution and not rely solely on technical indicators, as market dynamics are influenced by a multitude of factors.

Risk management is paramount in navigating an uncertain market environment. Traders should establish clear stop-loss levels and adhere to risk management principles to protect their capital. Emotions like fear and greed can cloud judgment and lead to impulsive trading decisions. Maintaining discipline and a rational approach to trading can help mitigate risks and enhance long-term profitability.

As traders gear up for the week ahead, it is essential to maintain a balanced perspective and avoid being swayed by short-term market fluctuations. A steadfast focus on long-term goals and a strategic approach to trading can help investors navigate choppy waters and capitalize on opportunities in a challenging market environment. By staying informed, disciplined, and adaptable, traders can position themselves for success despite the prevailing uncertainties in the market.