The link provided discusses market moves and perspective on the Nifty in the week ahead. The article delves into technical analysis, key levels, and indicators to watch for in the upcoming week.

In the broader context, it is essential for traders and investors to pay attention to various factors when analyzing market trends and making informed decisions. Technical analysis involves studying historical price data and market statistics to forecast future price movements. Indicators like moving averages, Relative Strength Index (RSI), and Bollinger Bands help in understanding market conditions and potential entry or exit points.

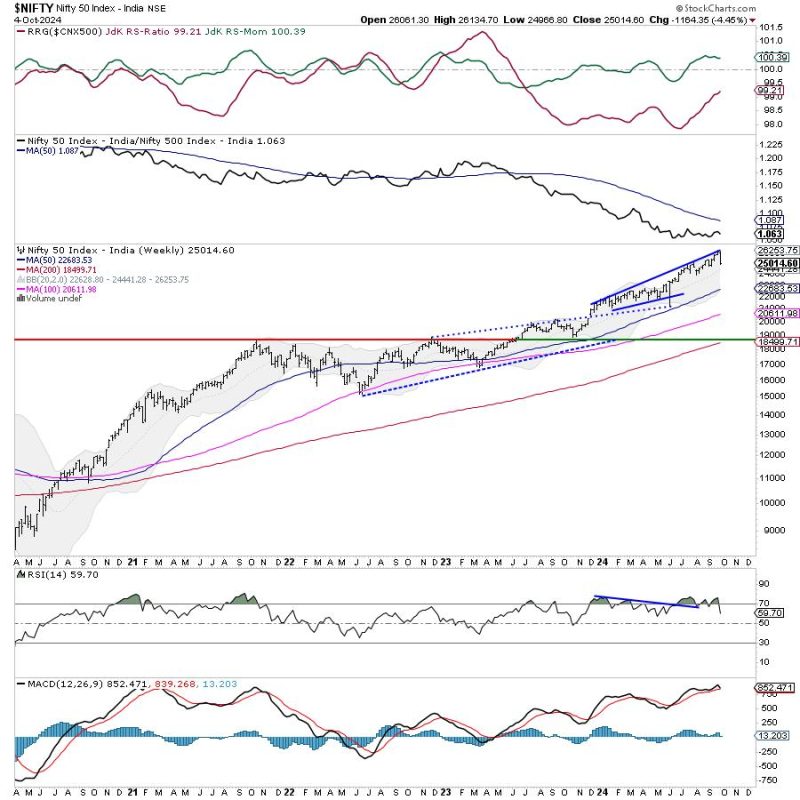

It is crucial to keep track of key support and resistance levels on charts, as they signify levels at which the price may reverse or continue its trend. Watching price action near these levels can provide valuable insights for decision-making. Moreover, trendlines and chart patterns can offer additional clues about market direction.

In analyzing the Nifty from a technical perspective, it is important to consider various factors like volume, momentum, and market breadth. These aspects paint a comprehensive picture of market sentiment and strength. Traders should also keep an eye on news and events that can impact market movements, as external factors often influence price action.

Overall, a well-rounded approach to market analysis involves combining technical indicators with fundamental research and staying updated on global economic developments. By incorporating multiple perspectives and utilizing tools like charting software and economic calendars, traders can enhance their decision-making process and capitalize on market opportunities.