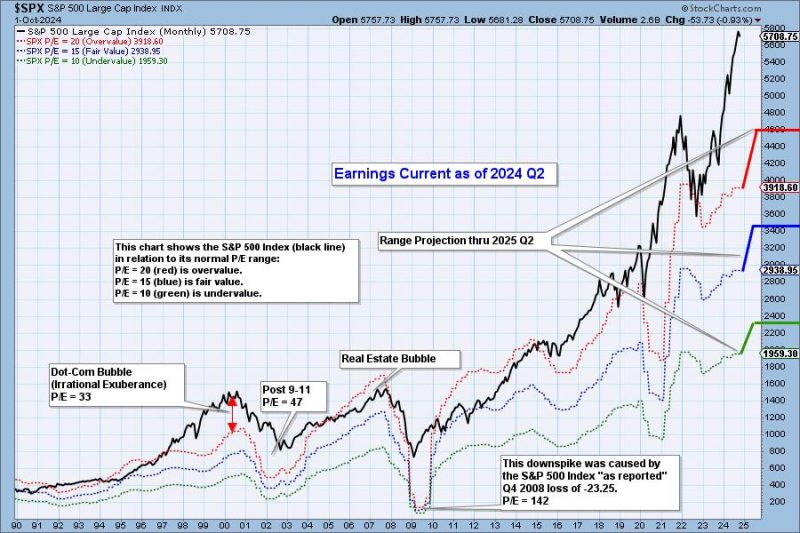

The article discusses valuable insights obtained from the 2024 Q2 earnings reports and the current state of the market, focusing on the issue of overvaluation. The earnings season is a crucial time for investors and analysts alike, as it provides a snapshot of how companies are faring in the current economic climate. Examining these reports allows for a deeper understanding of market conditions and the performance of individual companies.

In the case of 2024 Q2 earnings, several important trends have emerged, shedding light on the market’s overall health. One key observation is the widespread overvaluation present in many sectors. Overvaluation occurs when the market prices of stocks exceed their fundamental value, which can lead to risky investment decisions and market distortions.

With the market remaining very overvalued, investors face a challenging environment where caution and due diligence are paramount. It is essential to distinguish between companies whose valuations are justified by strong fundamentals and growth prospects and those that are riding a wave of speculative fervor.

One noteworthy point from the Q2 earnings reports is the variance between different sectors regarding overvaluation. Some sectors have seen a rapid increase in stock prices that outpaces their underlying performance, raising concerns about potential market bubbles. In contrast, other sectors have exhibited more modest valuations in line with their earnings growth.

Furthermore, the article explores the impact of overvaluation on investment strategies and risk management. Investors need to carefully assess the risk-reward balance of their portfolios and consider diversification as a means of mitigating exposure to overvalued assets. By maintaining a balanced and diversified investment approach, investors can navigate the uncertainties created by market overvaluation.

In conclusion, the 2024 Q2 earnings reports offer valuable insights into the market’s current state, particularly regarding the issue of overvaluation. By critically analyzing these reports and staying informed about market trends, investors can make well-informed decisions to protect and grow their wealth in a challenging investment climate.