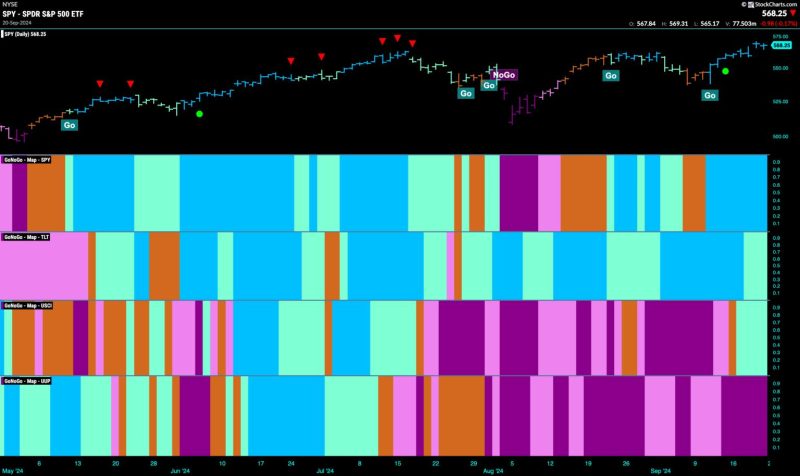

Equities Remain in Strong Go-Trend Powered by Financials

The global equity markets are currently experiencing a robust Go-Trend, largely driven by the strong performance of the financial sector. This positive momentum in equities is underpinned by several key factors that are shaping the investment landscape and influencing market dynamics.

One of the primary drivers of the ongoing bullish trend in equities is the resilience of the financial sector. Financial institutions have been reporting strong earnings, supported by robust economic growth and improved market conditions. The sector has benefited from a combination of factors, including rising interest rates, increased lending activity, and improved credit quality.

Another key factor contributing to the strength of equities is the healthy corporate earnings outlook. Companies across various sectors have been reporting solid earnings growth, propelled by strong consumer demand, improving business confidence, and favorable macroeconomic conditions. This positive earnings momentum has bolstered investor sentiment and provided a solid foundation for the ongoing rally in equities.

Furthermore, central bank policies continue to be supportive of equity markets. The Federal Reserve and other major central banks have maintained accommodative monetary policies, which have helped to sustain liquidity in the financial system and support asset prices. Low interest rates and ample liquidity have driven investors towards equities in search of higher returns, further fueling the current Go-Trend in the markets.

Geopolitical developments, while presenting occasional risks and uncertainties, have not derailed the upward trajectory of equities. Investors have largely shrugged off concerns surrounding trade tensions, political instability, and other geopolitical risks, as the underlying fundamentals of the global economy remain solid and supportive of continued growth.

In addition, technological advancements and digital innovation have played a significant role in driving equity market performance. Technology companies, in particular, have been at the forefront of market gains, benefiting from the increasing digitization of industries, changing consumer behaviors, and the rapid pace of technological disruption.

Overall, the strong Go-Trend in equities, powered by the financial sector and supported by a combination of positive factors, underscores the resilience and optimism in the markets. While periodic fluctuations and corrections are inevitable, the underlying fundamentals and ongoing tailwinds suggest that the bullish momentum in equities is likely to continue in the near term. Investors would do well to stay attuned to market developments, conduct thorough research, and maintain a diversified portfolio to navigate the dynamic investment landscape successfully.