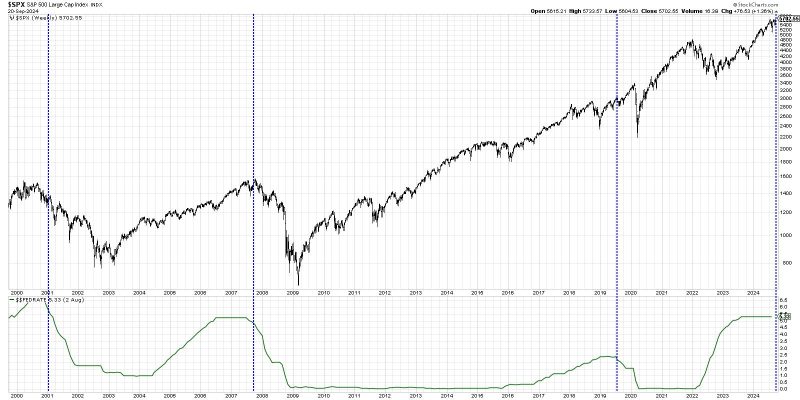

In the realm of financial markets, the dynamics between rate cuts and stock performance have been the subject of intense scrutiny and speculation among investors, analysts, and economists alike. The correlation between central bank rate decisions and the behavior of stock markets has been a topic of debate for many years. The basic premise is that when central banks cut interest rates, it can stimulate economic activity, leading to potentially positive outcomes for stock prices. However, the relationship is much more complex than a simple cause-and-effect scenario.

Histories of rate cuts by central banks around the world have shown mixed results in terms of their impact on stock performance. While rate cuts are often viewed as a bullish signal for equities, the actual market reaction can be influenced by a multitude of factors, including market sentiment, economic conditions, and geopolitical events. It is essential to understand that the stock market is driven by a combination of factors beyond just interest rates.

One significant factor to consider is the market expectations leading up to a rate cut announcement. If a rate cut is already priced into the market, the impact on stock prices may be minimal or short-lived. Conversely, if a rate cut comes as a surprise or is more aggressive than anticipated, it could lead to a more substantial market rally. Investors need to pay close attention to central bank communications and economic data to gauge the likelihood and magnitude of rate cuts.

Moreover, the broader economic landscape plays a crucial role in determining how rate cuts will impact stock performance. For example, in times of economic uncertainty or recession, rate cuts may be seen as a measure to stimulate growth and boost investor confidence. In such cases, stocks could benefit from lower borrowing costs and increased consumer spending. On the other hand, in a strong economy with concerns about inflation, rate cuts may be perceived as a sign of underlying weakness, leading to a more cautious reaction from investors.

It is also important to note that the impact of rate cuts on different sectors of the stock market can vary. While some sectors, such as interest-rate-sensitive industries like real estate and utilities, may benefit from lower borrowing costs, others, like financials, could face challenges due to narrower interest rate spreads. Investors should consider the sector-specific implications of rate cuts when assessing their potential impact on stock portfolios.

In conclusion, the relationship between rate cuts and stock performance is nuanced and multifaceted. While rate cuts can have a positive impact on stock prices under certain conditions, it is essential to consider a wide range of factors beyond just interest rates when making investment decisions. By staying informed, monitoring market developments, and maintaining a diversified portfolio, investors can navigate the complexities of rate cuts and position themselves for long-term success in the ever-evolving financial markets.