The article below is based on the information provided in the reference link.

Market sentiment plays a crucial role in determining the direction of financial markets. Investors and traders often rely on various indicators to gauge the prevailing sentiment and make informed decisions. In a recent analysis, three key market sentiment indicators have confirmed a bearish phase in the current market environment.

The first indicator highlighting the bearish sentiment is the Fear and Greed Index. This index combines various market indicators to assess the level of fear or greed in the market. A low score on the index indicates extreme fear among investors, potentially leading to selling pressure and market downturns. The recent readings on the Fear and Greed Index suggest an increase in fear, signaling a shift towards a bearish market sentiment.

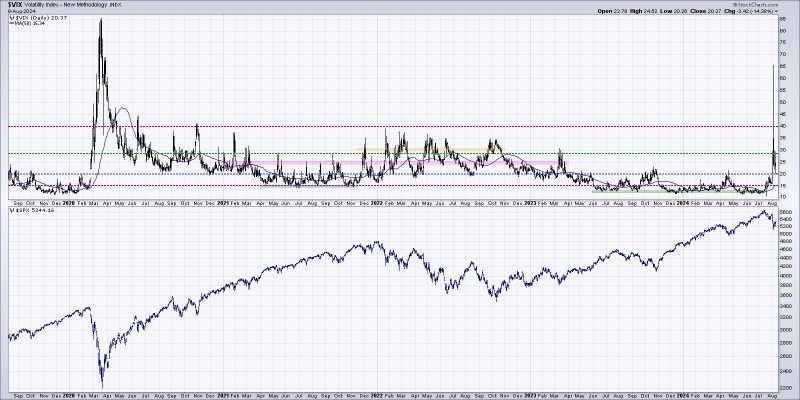

Another significant indicator confirming the bearish phase is the VIX, also known as the Volatility Index. The VIX measures market volatility and is often referred to as the fear gauge of the market. When the VIX is high, it indicates higher volatility and uncertainty, which are typically associated with bearish market conditions. Recent spikes in the VIX have aligned with the overall bearish sentiment in the market, reflecting heightened levels of fear and anxiety among investors.

The third indicator supporting the bearish outlook is the Put/Call Ratio. This ratio compares the volume of put options (which bet on market declines) to call options (which bet on market increases). A high put/call ratio suggests a higher level of bearish sentiment among traders, as more investors are hedging against potential market downside. The current readings on the Put/Call Ratio indicate a notable increase in bearish sentiment, further confirming the prevailing bearish phase in the market.

In conclusion, these three market sentiment indicators collectively validate the bearish outlook in the current market environment. Investors and traders need to closely monitor these indicators to navigate the market effectively and make well-informed decisions. By staying informed about market sentiment and leveraging the insights provided by these indicators, market participants can better position themselves to manage risks and capitalize on opportunities in volatile market conditions.