Semiconductors have been pivotal in driving technological advancements across various industries, playing a crucial role in the development of electronic devices and communication systems. One key indicator used by traders and analysts to gauge the performance of the semiconductor sector is the Semiconductor Holders (SMH) exchange-traded fund (ETF).

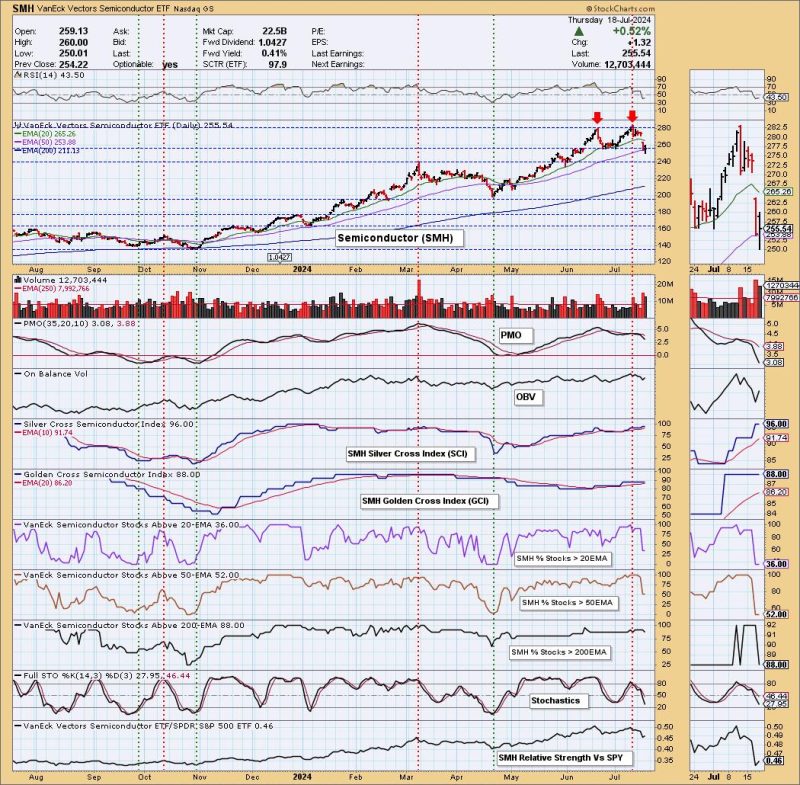

Recently, the SMH chart has shown a pattern known as a double top, which typically indicates a potential reversal in the upward trend. This pattern is characterized by two peaks at approximately the same price level, separated by a temporary decline in between. Traders often view the formation of a double top as a signal to be cautious and consider a change in trading strategy.

Analyzing the SMH chart with the double top formation, it is essential to consider various factors that could impact the future price movement of the ETF. Market sentiment, global economic conditions, and individual company performances within the semiconductor industry all play a role in influencing the price of the SMH ETF.

The appearance of a double top on the SMH chart may suggest a potential shift in investor sentiment towards semiconductor stocks. Traders and investors should closely monitor key support and resistance levels to assess the strength of the pattern and potential price targets in the event of a breakdown.

Technical indicators such as moving averages, volume analysis, and momentum oscillators can provide additional insights into the underlying strength or weakness of the double top pattern. Combining technical analysis with fundamental research on the semiconductor industry can help traders make more informed decisions regarding their positions in the SMH ETF.

It is important to note that market patterns and indicators are not foolproof and should be used in conjunction with other forms of analysis and risk management strategies. While a double top formation may signal a potential reversal, it is essential to consider the broader market context and emerging trends in the semiconductor sector before making trading decisions.

In conclusion, the appearance of a double top on the SMH chart highlights the need for caution and careful analysis in the semiconductor sector. Traders and investors should stay informed about the latest developments in the industry and market conditions to make well-informed decisions regarding their positions in semiconductor-related assets. By utilizing a combination of technical and fundamental analysis, market participants can navigate potential trend reversals and capitalize on opportunities in the dynamic semiconductor market.