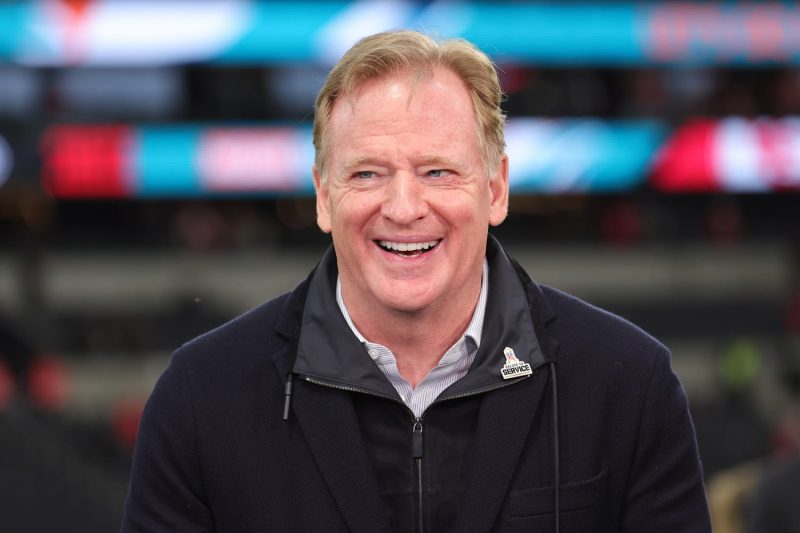

In the ever-evolving landscape of professional sports ownership, the NFL is poised to potentially open its doors to private equity investors seeking ownership stakes in its member teams. Recent comments from NFL Commissioner Roger Goodell indicate that the league is considering allowing private equity ownership of up to 10 percent of its franchises. This development could have significant implications for the future structure and operations of NFL teams.

Private equity ownership involves investment firms or individuals acquiring equity stakes in businesses, with the goal of ultimately turning a profit. In the context of the NFL, allowing private equity ownership could bring in substantial financial resources that could be utilized for various purposes, such as stadium upgrades, player acquisitions, and overall franchise development. This influx of capital could potentially help teams remain competitive in an increasingly demanding and costly sports market.

However, the prospect of private equity ownership in the NFL also raises important questions and considerations. One key concern is the potential influence that private equity investors could have on the decision-making processes within teams. Unlike traditional team owners who are often deeply invested in the community and the success of their franchise, private equity firms may prioritize profit-maximization above all else. This difference in priorities could potentially lead to clashes with the long-term interests of the team, its players, and its fan base.

Moreover, there are implications for the broader NFL ecosystem as well. Private equity ownership could introduce a new dynamic into league operations, with potential ramifications for revenue sharing, competitive balance, and overall league governance. The NFL, like many professional sports leagues, has traditionally operated under a model that emphasizes parity and collective decision-making among team owners. The entry of private equity investors could disrupt this established framework and introduce new complexities into the league’s structure.

On the positive side, private equity ownership could bring fresh perspectives, innovative approaches, and strategic investments that benefit teams and the league as a whole. The financial resources and expertise that private equity firms bring to the table could help NFL teams navigate challenges, seize opportunities, and enhance their overall competitiveness. In a rapidly changing sports landscape, where technological advancements, shifting fan preferences, and economic forces are reshaping the industry, the infusion of private equity capital could position NFL teams for sustained success in the long run.

Ultimately, the decision to allow private equity ownership in the NFL will require careful consideration and a thorough evaluation of its potential impacts. While the prospect of increased financial resources and strategic partnerships may be enticing, it is essential to weigh the potential trade-offs and risks that come with private equity ownership. As the NFL continues to explore this possibility, stakeholders across the league must engage in thoughtful discussions and deliberations to ensure that any decisions made align with the best interests of the teams, the players, and the fans.