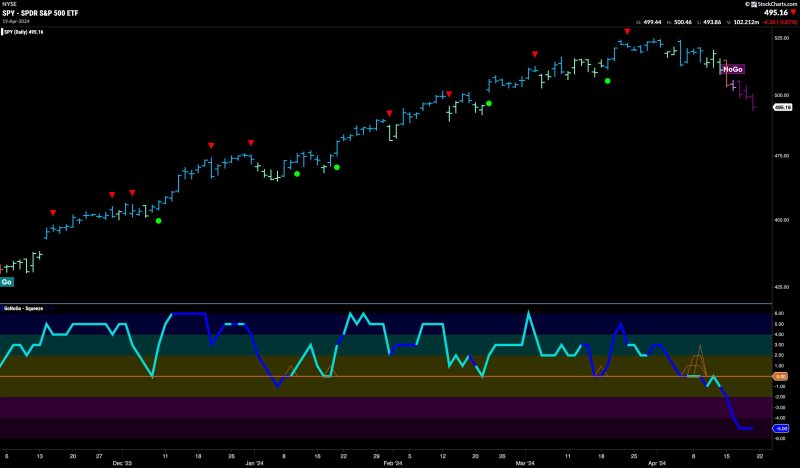

Equities Struggle in Strong Nogo as Materials Try to Curb the Damage

The global equity markets have been facing a tough time in the recent period due to various economic and geopolitical factors. Investors and analysts are closely watching the developments in different sectors to gauge the overall market sentiment and potential opportunities. In the midst of this tumultuous environment, the materials sector is attempting to cushion the impact and minimize the damage to equities.

One of the primary drivers of the challenges faced by equities is the concept of Strong Nogo, which refers to a situation where investors are hesitant to enter the market or make significant investments due to uncertainties and risks. This cautious approach can result in lower trading volumes, increased volatility, and overall downward pressure on stock prices.

In such a scenario, the materials sector plays a crucial role in providing some stability and support to equities. This sector includes companies involved in the production and distribution of raw materials, commodities, and industrial products. Despite the overall market downturn, materials companies have been working to mitigate the negative impact and maintain a semblance of balance in the equity markets.

One strategy employed by materials companies is to focus on cost efficiencies and operational improvements to strengthen their financial positions. By streamlining operations, reducing expenses, and optimizing supply chains, these companies can enhance their profitability and weather the storm of market uncertainty more effectively. Additionally, investments in research and development can lead to innovative products and processes that give materials companies a competitive edge in challenging times.

Furthermore, materials companies are also exploring strategic partnerships and alliances to diversify their revenue streams and expand their market presence. Collaborating with other entities in the industry or forming joint ventures can provide access to new markets, technologies, and resources that contribute to long-term growth and resilience. By forging strong partnerships, materials companies can navigate the volatile market conditions and emerge stronger on the other side.

Another key aspect of the materials sector’s efforts to support equities is sustainability and environmental responsibility. Investors and consumers are increasingly prioritizing companies that demonstrate a commitment to sustainability and conservation. Materials companies that embrace eco-friendly practices, reduce carbon emissions, and promote responsible sourcing of raw materials are not only meeting societal expectations but also enhancing their reputation and attractiveness to investors.

In conclusion, while equities are struggling in the face of Strong Nogo sentiment and market uncertainties, the materials sector is stepping up to mitigate the damage and provide stability to the broader market. By focusing on cost efficiencies, strategic partnerships, innovation, and sustainability, materials companies are playing a crucial role in supporting equities and navigating through challenging times. As investors continue to monitor the developments in the materials sector, there may be opportunities for value creation and sustainable growth in the midst of market volatility.