In the realm of finance and investment, the implementation of rules-based money management strategies has become increasingly popular among traders and investors. As part of these strategies, security ranking measures play a crucial role in identifying potential investment opportunities and managing risk effectively. By evaluating various aspects of securities, these ranking measures aid in making informed decisions and achieving financial goals. In this article, we delve into the significance of security ranking measures in rules-based money management and explore some of the common methods used in the evaluation process.

One key aspect of security ranking measures is the consideration of fundamental factors that can impact the performance of a security. Fundamental analysis involves assessing financial statements, business operations, industry trends, and economic indicators to gauge the underlying value of a security. By examining metrics such as earnings growth, revenue trends, profit margins, and debt levels, investors can gain insights into the financial health and future prospects of a company. This information is essential for ranking securities based on their fundamental strength and growth potential.

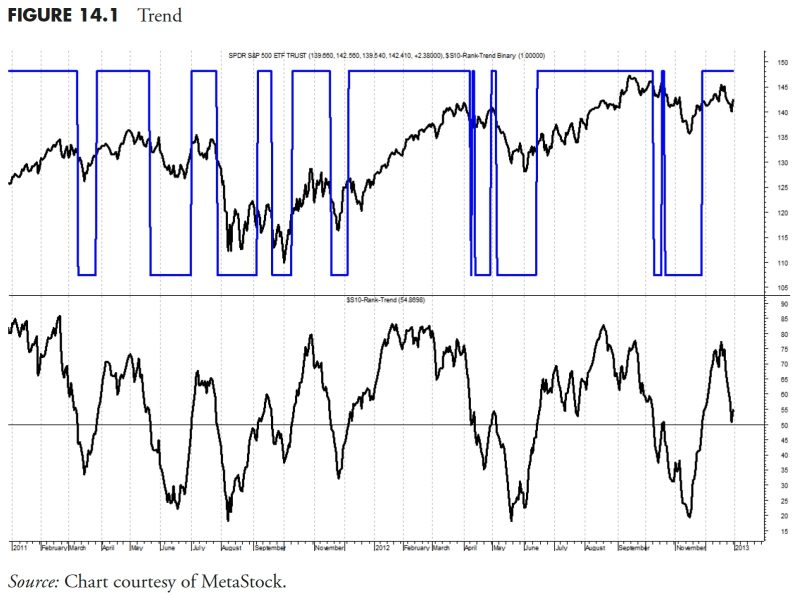

Technical analysis is another important component of security ranking measures that focuses on historical price movements and trading volume to predict future price trends. By analyzing chart patterns, trend lines, and momentum indicators, traders can identify entry and exit points for securities. Technical analysis helps in determining the timing of trades and managing risk by setting stop-loss orders and profit targets. By incorporating technical indicators into security ranking measures, investors can enhance their decision-making process and improve the performance of their portfolios.

Apart from fundamental and technical analysis, qualitative factors also play a significant role in security ranking measures. These factors may include industry dynamics, competitive positioning, management quality, and corporate governance practices. By conducting thorough research and analysis on these qualitative aspects, investors can gain a deeper understanding of the risks and opportunities associated with a security. Integrating qualitative factors into security ranking measures provides a comprehensive view of the investment landscape and enables investors to make well-informed decisions.

Risk management is a crucial consideration in rules-based money management, and security ranking measures play an essential role in assessing the risk profile of securities. By evaluating factors such as volatility, correlation, and beta, investors can determine the level of risk associated with each security in their portfolio. Diversification across asset classes, industries, and geographical regions is another important strategy for managing risk effectively. Security ranking measures help investors in identifying diversified investment opportunities that can reduce overall portfolio risk.

In conclusion, security ranking measures are integral to rules-based money management strategies as they provide a systematic approach to evaluating securities and making investment decisions. By considering fundamental, technical, and qualitative factors, investors can rank securities based on their potential for growth, value, and risk. Incorporating security ranking measures into investment processes enhances decision-making, improves portfolio performance, and ensures effective risk management. In the dynamic and ever-changing world of finance, utilizing security ranking measures is essential for achieving long-term financial success.