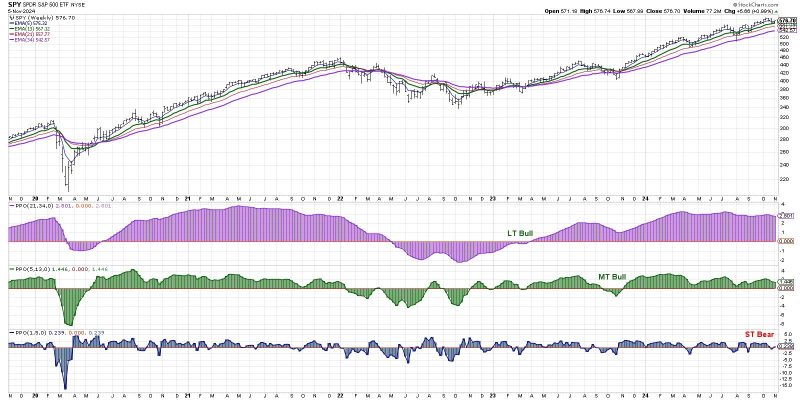

The article from the provided link discusses how a short-term bearish signal is looming over the markets as investors brace for a week filled with significant news events. Let’s dive deeper into the factors contributing to this market sentiment.

The first point of concern highlighted in the article is the ongoing trade tensions between the United States and China. The uncertainty surrounding the trade negotiations has been a key driver of market volatility in recent months. Any negative developments or escalations in the trade dispute can further exacerbate the bearish sentiment among investors.

Furthermore, the upcoming Federal Reserve meeting has also put investors on edge. The Fed’s decision on interest rates and its outlook on the economy can have a significant impact on market sentiment. Any hints of a more aggressive stance on monetary policy or concerns about economic growth could trigger a sell-off in the markets.

In addition to the trade tensions and the Fed meeting, the article also mentions the upcoming earnings reports from major companies. Earnings season can be a make-or-break period for stocks, and any disappointing earnings results or guidance could lead to downside pressure on the overall market.

Moreover, geopolitical uncertainties such as Brexit and tensions in the Middle East are additional factors that could contribute to the bearish sentiment in the market. These geopolitical events have the potential to create sudden shocks to the market and unsettle investors’ confidence.

Overall, the combination of these factors has created a sense of caution among investors, leading to a short-term bearish signal in the markets. As investors prepare for a news-heavy week, it is crucial for them to stay informed and be prepared to navigate potential market turbulence. Keeping a close eye on developments in trade negotiations, the Fed’s decision, earnings reports, and geopolitical events will be essential in managing investment portfolios during this uncertain period.