The article talks about the potential range-bound movement of Nifty in the upcoming week and highlights the key levels that need to be breached for any significant trending moves to occur. This analysis provides valuable insights for traders and investors to anticipate potential market movements and make informed decisions.

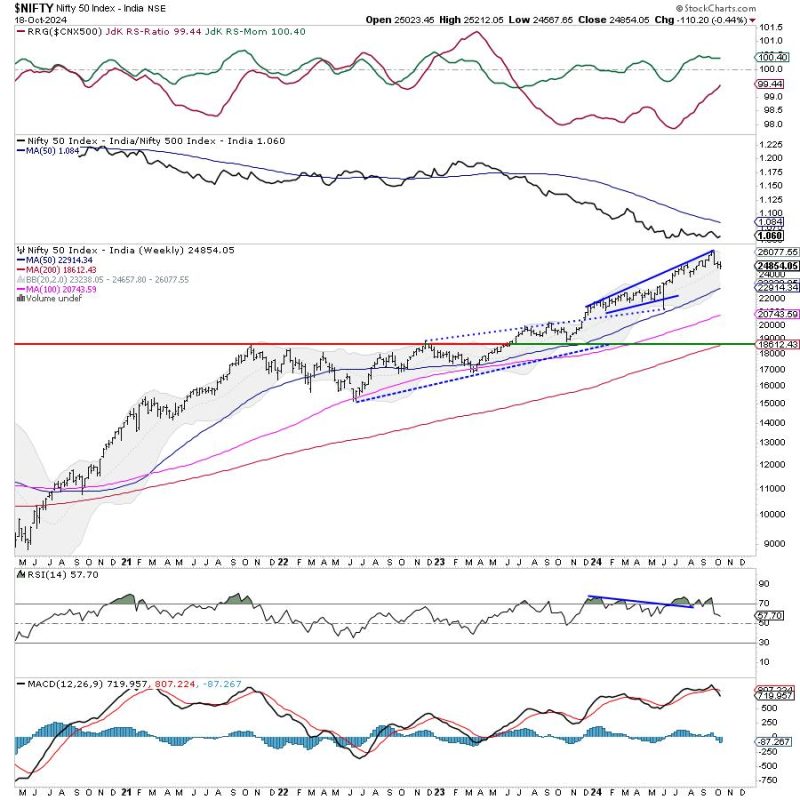

The Nifty index has been consolidating within a range in recent trading sessions, and this trend is expected to continue in the coming week. Market analysts predict that unless certain key levels are breached, significant trending moves are unlikely to occur. This suggests that the Nifty may remain range-bound in the short term.

One of the critical levels to watch out for is the upper resistance level near 15,900. Breaking above this level could indicate a bullish momentum and potential upside for the index. On the other hand, the lower support level around 15,600 acts as a crucial barrier that, if breached, could signal a bearish trend and potential downside for the market.

Traders and investors are advised to closely monitor these levels and wait for a decisive breakout before taking any significant positions. It is essential to exercise caution and wait for confirmation of a clear trend before making any trading decisions.

In addition to the technical levels, market participants should also pay attention to macroeconomic factors and global market trends that could impact the movement of the Nifty index. Geopolitical events, economic data releases, and central bank announcements are all factors that could influence market sentiment and direction.

Overall, the outlook for the Nifty index in the upcoming week points towards a continuation of the current range-bound movement. Traders should be prepared for potential trending moves only if key resistance and support levels are breached. By staying informed and following market developments closely, investors can make more informed decisions and navigate the dynamic landscape of the stock market effectively.