Rules-Based Money Management – Measuring the Market

In the world of finance and investment, rules-based money management plays a crucial role in helping investors make informed decisions. One key aspect of this approach is the measurement of the market. By utilizing various tools and techniques, investors can gain valuable insights into market trends and behaviors, enabling them to adjust their investment strategies and minimize risks.

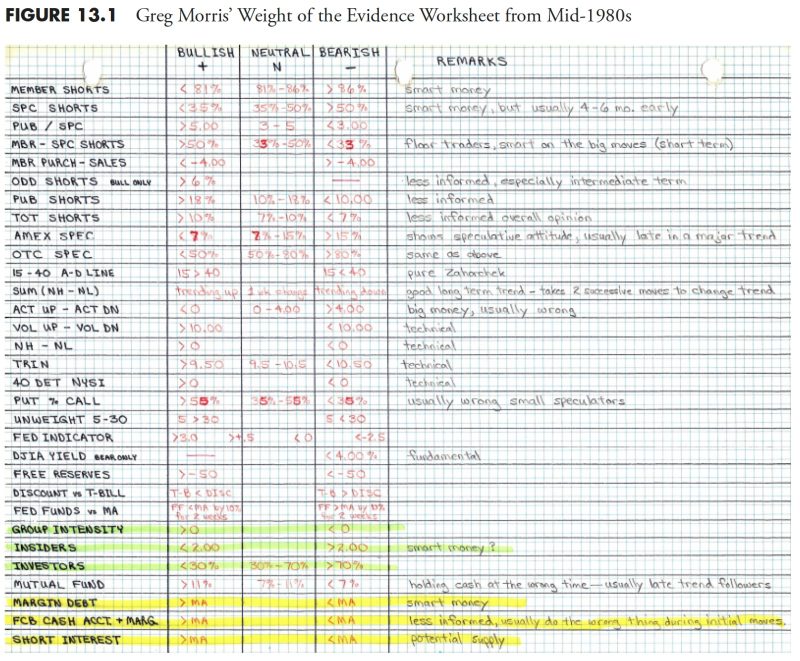

One common method used to measure the market is through the use of technical analysis. This involves analyzing historical price movements and volume data to identify patterns and trends that can help predict future price movements. By using tools such as moving averages, relative strength index (RSI), and Fibonacci retracements, investors can better understand the dynamics of the market and make more informed trading decisions.

Another important aspect of measuring the market is assessing market sentiment. This involves monitoring investor attitudes and emotions towards the market, which can have a significant impact on price movements. By tracking indicators such as the put/call ratio, investor surveys, and news sentiment, investors can gauge market sentiment and adjust their strategies accordingly.

Fundamental analysis is also a crucial tool for measuring the market. This involves evaluating a company’s financial health, industry trends, and macroeconomic factors to determine its true value. By analyzing factors such as earnings growth, revenue projections, and interest rates, investors can gain a deeper understanding of the market and identify potential investment opportunities.

Moreover, measuring market breadth and depth is essential for investors seeking to gauge the overall health of the market. Market breadth refers to the number of securities advancing relative to those declining, while market depth measures the extent of buying and selling activity in the market. By using indicators such as advance-decline lines, market indices, and trading volume, investors can assess market breadth and depth and make more informed decisions.

In conclusion, measuring the market is a vital aspect of rules-based money management that can help investors navigate the complex world of finance and investment. By utilizing a combination of technical analysis, market sentiment, fundamental analysis, and market breadth and depth, investors can gain valuable insights into market trends and behaviors, enabling them to adjust their investment strategies and minimize risks. By staying informed and proactive, investors can increase their chances of success in the dynamic and ever-changing world of financial markets.