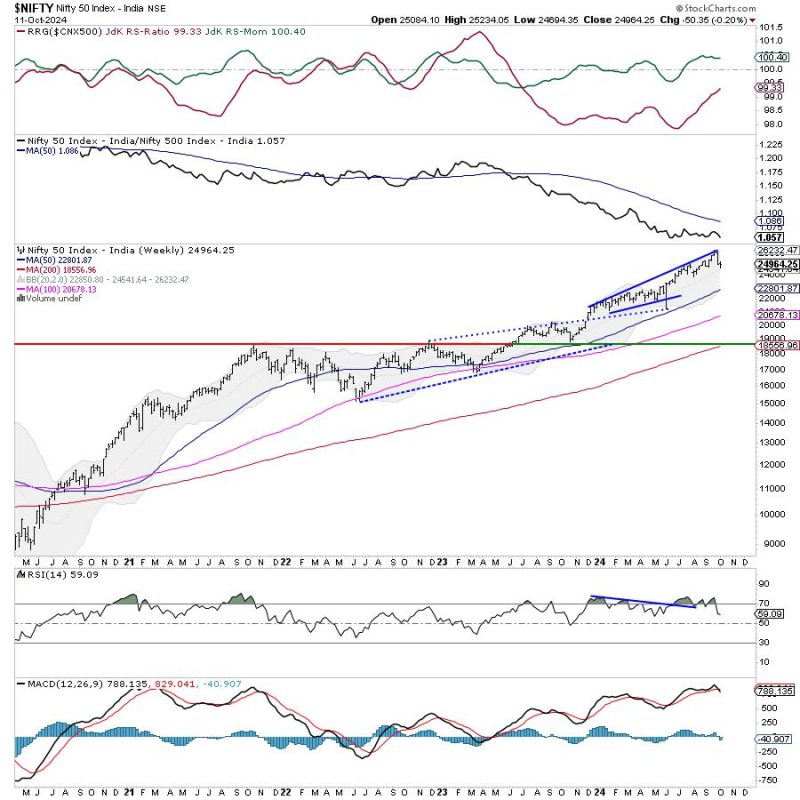

In the current financial climate, investors and traders are keeping a close eye on the movements of the Nifty as they navigate their trading decisions. As the Nifty consolidates, it is important to maintain a strategic approach and pay attention to key levels that could impact market direction.

One crucial level to monitor is the support level at 15,250. This level has played a significant role in providing a floor for the Nifty in recent trading sessions. If the Nifty falls below this level, it could signal a shift in market sentiment and potentially lead to further downside movement. Traders should be prepared to adjust their positions accordingly if this support level is breached.

On the upside, the resistance level at 15,500 is another key level to watch. A decisive breakout above this level could indicate a bullish momentum and potentially open the door for further gains. Traders should monitor price action near this level for potential buying opportunities or confirmations of upward momentum.

Additionally, keeping an eye on the 50-day moving average can provide valuable insights into the overall trend of the Nifty. If the Nifty remains above this moving average, it could be an indication of a bullish trend. Conversely, a move below the 50-day moving average could signal a shift in sentiment and potential downside pressure.

Amidst the consolidation phase of the Nifty, traders should remain cautious and proactive in managing their positions. Utilizing stop-loss orders and risk management strategies can help protect against unforeseen market movements. Keeping a watchful eye on key levels and indicators can provide valuable guidance for navigating the market in the weeks ahead.

In conclusion, as the Nifty consolidates, traders should focus on maintaining a disciplined approach and monitoring crucial levels that could impact market direction. By staying informed and prepared, traders can make well-informed decisions and navigate the market with confidence.