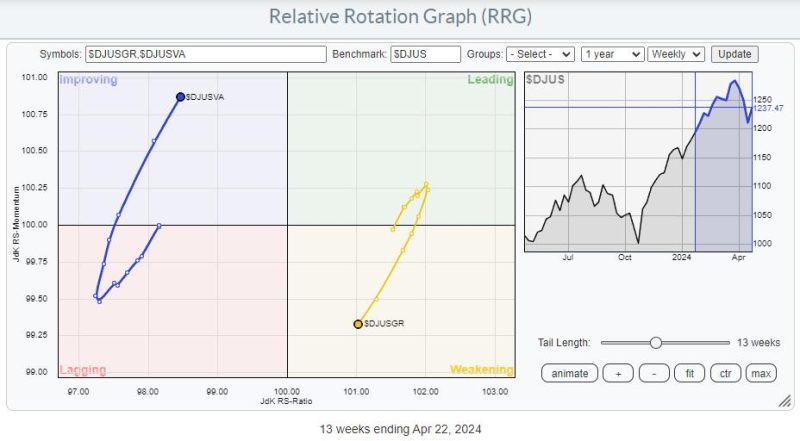

In a recently shifting market landscape, investors are beginning to witness a noticeable change in dynamics. With value stocks gaining prominence over growth stocks, there are potential downside risks looming for the stock market as a whole. This paradigm shift marks a significant departure from the trend seen in recent years.

One of the key downside risks faced by investors is the potential for a market correction. As value stocks rise in popularity, growth stocks, which have been the darlings of the market for some time, could see a decline in value. This shift in sentiment could trigger a broader market correction that may catch many investors off guard.

Moreover, another downside risk for stocks as value takes the lead is the impact on technology stocks. The tech sector, which has been a major driver of market gains in recent years, could see a slowdown in performance as investors rotate into value stocks. This could lead to increased volatility and uncertainty in the market, potentially dampening overall returns.

Additionally, as interest rates begin to rise, there is a risk that high-flying growth stocks could come under pressure. Rising interest rates can make borrowing more expensive, which could weigh on the profitability of high-growth companies that rely on debt financing. This could contribute to a broader sell-off in growth stocks, further exacerbating downside risks for the market.

Furthermore, geopolitical tensions and global events also pose a threat to the stock market as value takes the lead. Uncertainty surrounding trade agreements, political instability, and other macroeconomic factors could spook investors and lead to increased market volatility. Such events have the potential to trigger sell-offs in both growth and value stocks, affecting the broader market.

Another downside risk that investors should be mindful of is the impact of inflation on stock performance. Inflationary pressures could erode real returns on investments, leading investors to seek refuge in value stocks that are perceived to be more resilient in times of economic uncertainty. However, if inflation continues to rise, it could dampen overall market sentiment and lead to a sell-off across all sectors.

Moreover, the increasing prevalence of environmental, social, and governance (ESG) considerations could also pose a downside risk for stocks as value takes the lead. Companies that fail to meet ESG standards may face increased scrutiny from investors, leading to lower stock prices and underperformance. This could impact both growth and value stocks alike, adding another layer of risk to the market.

Lastly, the potential for a market bubble is a significant downside risk for stocks as value gains favor. As investors pile into value stocks in search of bargains, there is a risk of asset prices becoming disconnected from their underlying fundamentals. If this trend continues unchecked, it could lead to a market bubble that eventually bursts, causing widespread losses for investors.

Overall, while the shift towards value stocks may present new opportunities for investors, it also brings with it a host of downside risks for the stock market. From the potential for a market correction to the impact on tech stocks, rising interest rates, geopolitical tensions, inflation, ESG considerations, and the risk of a market bubble, investors must remain vigilant and carefully assess the changing market dynamics to navigate these challenges successfully.