In the world of finance, the rise of cryptocurrency has brought both innovation and risk. While many have seen significant gains from investing in digital assets, others have unfortunately fallen victim to various scams and fraudulent schemes. One such case that shocked the financial community and led to devastating consequences was the cryptocurrency pig-butchering scam that wrecked a Kansas bank and sent its ex-CEO to prison for 24 years.

The intricate web of deceit began when the ex-CEO, Alan Smith, who was once highly regarded in the banking industry, sought to exploit the booming popularity of cryptocurrencies for personal gain. Smith, known for his charm and charisma, convinced the bank’s board of directors to venture into the world of cryptocurrencies, promising unprecedented returns and positioning the bank as a pioneer in the digital asset space.

What seemed like a strategic move at the time quickly unraveled into a nightmare for the bank and its customers. Unbeknownst to the board and regulators, Smith had secretly set up a Ponzi-like scheme disguised as a cryptocurrency investment fund. Using the bank’s resources and customers’ funds, he lured unsuspecting investors with promises of incredible profits by investing in pig-butchering facilities that supposedly utilized cutting-edge blockchain technology.

As investments poured in, Smith’s scheme grew more elaborate, with falsified reports and statements painting a rosy picture of the fund’s success. However, the truth eventually came to light when whistleblowers within the bank raised concerns about the legitimacy of the investments and the suspicious nature of the returns being promised.

An extensive investigation by regulatory authorities uncovered the depth of Smith’s deception, revealing that the pig-butchering facilities he claimed to have invested in were non-existent, and the returns paid to early investors were funded by the contributions of new investors. The once-thriving bank now faced insolvency, its reputation tarnished, and countless investors left devastated by the loss of their hard-earned money.

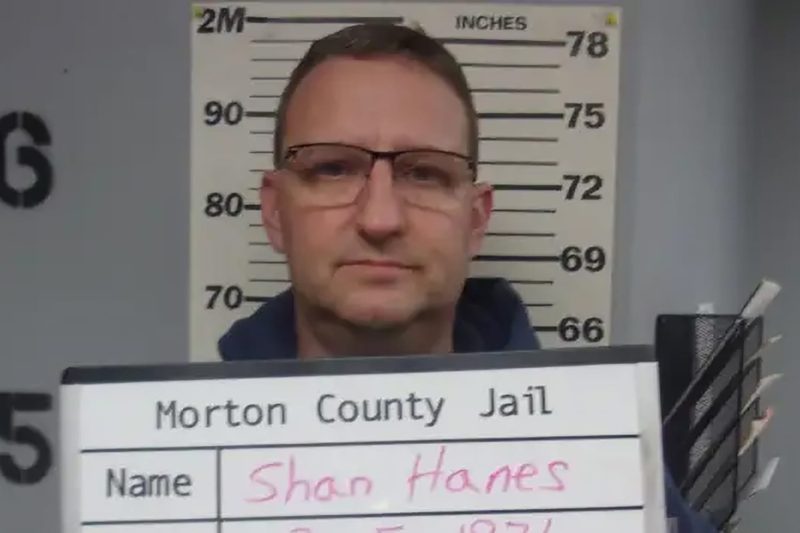

In a swift turn of events, Smith’s deception caught up with him, leading to his arrest and subsequent trial. The court found him guilty of multiple counts of fraud, money laundering, and other financial crimes, resulting in a staggering 24-year prison sentence. His fall from grace served as a cautionary tale for those who seek to exploit the burgeoning cryptocurrency market for fraudulent schemes.

The aftermath of the cryptocurrency pig-butchering scam sent shockwaves through the financial industry, prompting renewed scrutiny of cryptocurrency investments and the individuals involved in promoting them. Investors were reminded of the importance of due diligence and vigilance when considering investment opportunities, especially in the rapidly evolving world of digital assets.

As the dust settled on this catastrophic event, the Kansas bank worked tirelessly to rebuild its reputation and regain the trust of its customers. Though scarred by the experience, the bank emerged with valuable lessons learned, ensuring that such a devastating scam would never again be allowed to threaten its stability and integrity.

In conclusion, the cryptocurrency pig-butchering scam that wreaked havoc on a Kansas bank serves as a stark reminder of the dangers lurking in the world of digital assets. Through deceit, manipulation, and greed, individuals like Alan Smith can inflict significant harm on unsuspecting investors and institutions. The fallout from such schemes underscores the need for transparency, accountability, and regulatory oversight to safeguard against financial fraud and protect the integrity of the financial system.