The Week Ahead: Nifty Stays Tentative as Defensive Setup Develops – Know These Levels Well

This week, the Nifty continued to trade cautiously, as global uncertainties and domestic concerns weighed on market sentiment. As a defensive setup starts to take shape, investors are advised to be aware of key levels in the market to navigate their trades effectively.

Levels to Watch:

1. Support at 14,300: The Nifty has found support around the 14,300 level, which marks a crucial psychological support zone. Any breach below this level could indicate further downside pressure on the market.

2. Resistance at 14,600: On the upside, the 14,600 level acts as a key resistance area for the Nifty. If the index manages to break above this level, it could signal a potential bullish reversal in the near term.

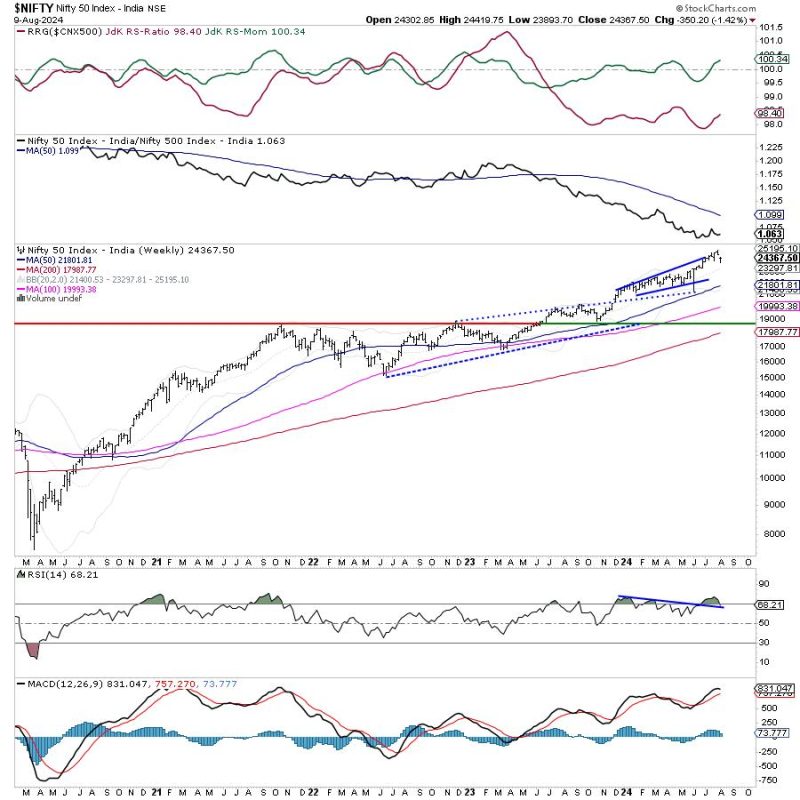

3. 50-Day Moving Average: The 50-day moving average currently stands around 14,500 and could act as a dynamic support/resistance level. Traders should keep a close watch on how the Nifty interacts with this moving average in the coming sessions.

Technical Indicators:

1. Relative Strength Index (RSI): The RSI indicator is currently hovering around the 45-50 range, indicating a neutral stance on the market. Traders should look for confirmation signals from the RSI before making any trading decisions.

2. Moving Average Convergence Divergence (MACD): The MACD line has crossed below the signal line, signaling a bearish momentum in the short term. However, traders should await further confirmation from the MACD to validate this signal.

3. Volatility Index (VIX): The VIX has seen a slight uptick in recent sessions, indicating increased volatility in the market. Traders should be prepared for heightened price swings and adjust their risk management strategies accordingly.

Potential Catalysts:

1. Global Developments: Any major developments in the global economy, including geopolitical tensions or monetary policy decisions, could influence market sentiment and drive price action in the Nifty.

2. Economic Data: Key economic indicators, such as GDP growth, inflation, and industrial output, could provide insights into the health of the Indian economy and impact investor confidence in the market.

3. Corporate Earnings: The upcoming earnings season could offer valuable insights into the performance of Indian companies and their outlook for the future. Positive earnings surprises could boost market sentiment, while disappointments could lead to sell-offs.

In conclusion, the Nifty remains tentative as a defensive setup develops, with key levels playing a crucial role in determining market direction. By staying informed about technical indicators, potential catalysts, and market levels, traders can make well-informed decisions and navigate the market with confidence.