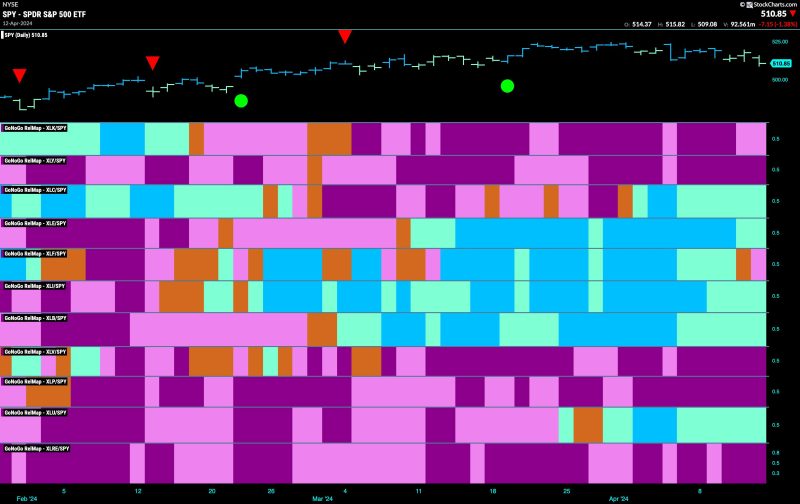

Equity Markets Struggle to Hold Onto Go-Trend as Industrials Try to Lead

The world of equity markets has been a roller coaster ride in recent times, with investors constantly keeping an eye on the trends and patterns that emerge. As we delve into the intricate workings of the financial sector, we witness a struggle unfolding as equity markets attempt to maintain the upward momentum that had characterized their journey, while industrials emerge as a potential guiding force in the market landscape.

In the latest developments observed on April 15, 2024, the equity markets demonstrated a juxtaposition of conflicting forces at play. On one hand, the markets grappled to maintain a hold on the ‘go-trend,’ a term that signifies the push for positive growth and upward movement in the market. However, this upward trajectory was not without its challenges, as various factors threatened to disrupt the trend and create a sense of instability.

Amidst this backdrop, the industrials sector emerged as a notable player in the market dynamics, as it showcased the potential to lead the way forward. Industrials, encompassing a diverse range of companies involved in manufacturing, construction, engineering, and other related activities, demonstrated resilience and strength in the face of the prevailing uncertainties. Investors turned their attention to the industrials sector, seeking opportunities for growth and stability in light of the fluctuating market conditions.

One key aspect that fueled the interest in industrials was the sector’s fundamental role in driving economic activity and growth. As the backbone of industrial production and infrastructure development, these companies possess the capacity to influence broader economic trends and serve as a barometer for the overall health of the economy. In a landscape marked by volatility and uncertainty, the industrials sector offered a semblance of reliability and predictability, attracting investors looking for steady returns and long-term growth prospects.

Moreover, the industrials sector’s performance on April 15, 2024, highlighted the sector’s ability to navigate challenges and capitalize on opportunities. Whether through innovations in technology, improvements in operational efficiency, or strategic partnerships and acquisitions, industrials companies showcased their adaptability and forward-thinking approach. This proactive stance resonated with investors seeking companies with a strong foundation and a vision for sustainable growth in the long run.

Despite the industrials sector’s promising performance, the broader equity markets continued to grapple with various headwinds that tested their resilience. Uncertainties surrounding geopolitical events, economic policies, global supply chain disruptions, inflationary pressures, and other macroeconomic factors cast a shadow of uncertainty over the markets, making it increasingly challenging to sustain the ‘go-trend’ momentum.

In conclusion, the dynamics witnessed in the equity markets on April 15, 2024, underscore the complex interplay of forces that shape the financial landscape. While the struggle to maintain the ‘go-trend’ persists, the industrials sector emerges as a beacon of stability and growth potential, offering investors a ray of hope in turbulent times. As we navigate the intricacies of the financial world, it becomes clear that a nuanced understanding of market trends and a strategic approach to investment are essential for success in today’s ever-evolving and unpredictable market environment.