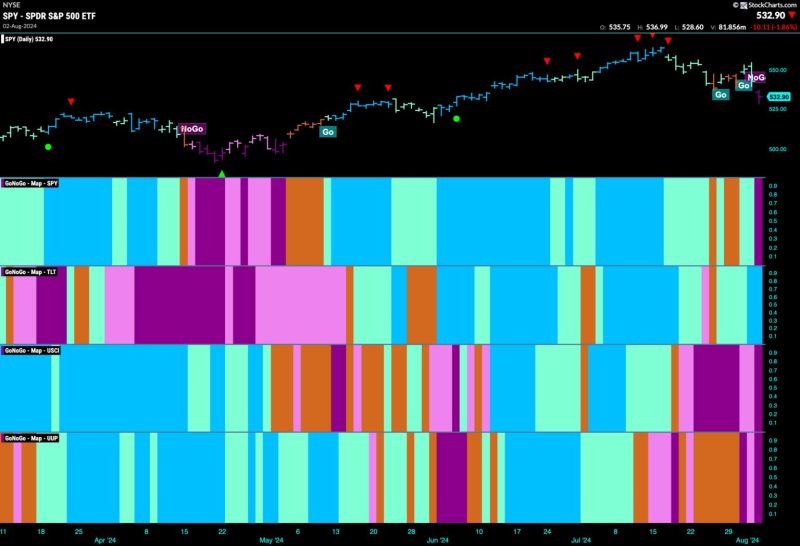

Stocks Get Defensive as Market Index Enters ‘NoGo’ Zone

The recent shifts in the stock market have raised concerns among investors as the market index enters what experts are referring to as the ‘NoGo’ zone. This term is used to describe a period of uncertainty and caution in the market when certain indicators suggest a potential downturn. In response to this changing landscape, many investors are turning to defensive stocks as a way to protect their portfolios and minimize risk.

Defensive stocks are those that tend to perform well even during economic downturns or periods of market volatility. These stocks are often characterized by stable earnings, strong cash flows, and a history of consistent dividend payments. While defensive stocks may not offer the same high returns as growth stocks during bull markets, they are generally less volatile and provide a measure of stability during turbulent times.

One sector that typically attracts investors looking for defensive options is healthcare. Healthcare stocks are often seen as a safe haven because demand for healthcare services and products tends to remain relatively constant regardless of economic conditions. Companies in the healthcare sector are also less sensitive to fluctuations in interest rates or consumer spending, making them a popular choice for risk-averse investors.

Another sector that is often considered defensive is consumer staples. These are companies that produce essential goods like food, beverages, and household items that consumers continue to purchase even when money is tight. Companies in the consumer staples sector are generally less cyclical than those in other industries, making them a reliable choice for investors seeking stability in uncertain times.

Utilities are yet another sector that is known for its defensive characteristics. Utility companies provide essential services like electricity, water, and gas, which are required by consumers regardless of economic conditions. In addition, many utility companies have a regulated business model that ensures predictable revenue streams and stable cash flows, making them a popular choice among conservative investors.

While defensive stocks can be a prudent choice during times of market uncertainty, it’s important to remember that no investment is completely risk-free. Even the most defensive stocks can be impacted by broader economic factors or industry-specific challenges. Investors should carefully research and assess individual companies before adding them to their portfolios, taking into account factors like valuations, growth prospects, and competitive positioning.

In conclusion, as the market index enters the ‘NoGo’ zone, investors are increasingly turning to defensive stocks as a way to protect their portfolios and navigate volatile market conditions. Sectors like healthcare, consumer staples, and utilities are popular choices for those seeking stability and reliability in their investments. While no investment is without risk, defensive stocks can provide a measure of security and peace of mind during uncertain times.