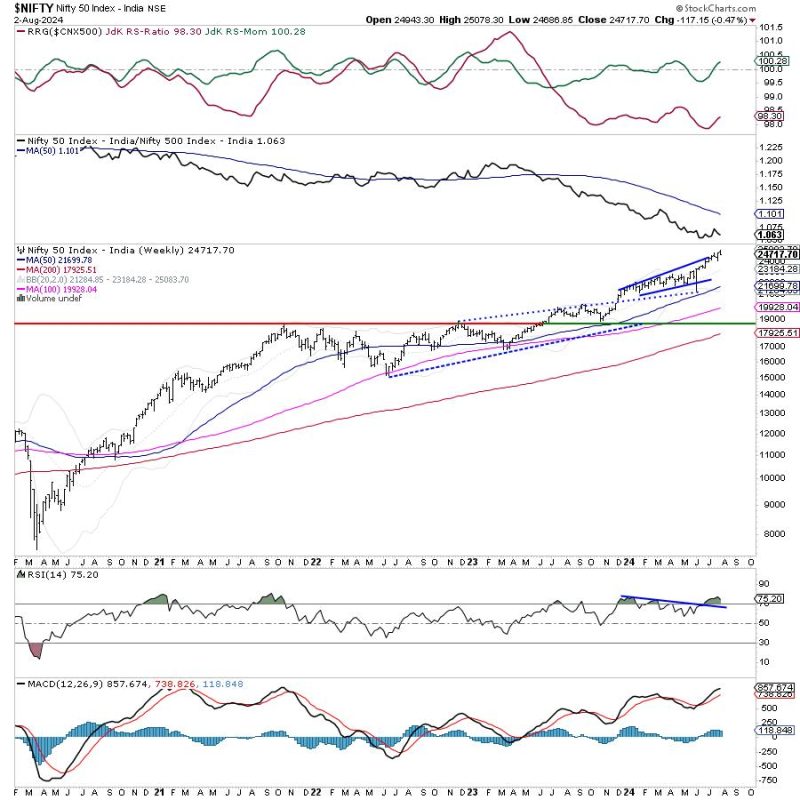

As the trading week unfolds, investors are keenly watching movements in the Nifty index, which remains susceptible to bouts of profit-taking. While the past week displayed strong bullish momentum, there are factors to consider for safeguarding profits and focusing on stock-specific opportunities.

Firstly, it is essential to stay vigilant about profit-taking instances in the market. The Nifty index has seen substantial gains recently, prompting some investors to take profits off the table and causing fluctuations in the broader market. By staying attentive to these potential reversals, investors can proactively adjust their positions or implement risk management strategies to safeguard gains.

Moreover, investors should guard their profits by diversifying their portfolios and managing risk effectively. Diversification across sectors and asset classes can help mitigate losses in case of market downturns. Additionally, setting stop-loss orders and trailing stops can protect profits and limit downside risks, providing a safety net during volatile market conditions.

Furthermore, it is crucial to focus on stock-specific opportunities amidst market uncertainties. By conducting thorough research and analysis, investors can identify undervalued stocks with strong fundamentals and growth potential. Identifying promising investment prospects beyond the broader market trends can yield significant returns and reduce dependency on index movements.

Additionally, staying informed about macroeconomic events and corporate developments is key to making informed investment decisions. By monitoring economic indicators, central bank policies, and company earnings reports, investors can anticipate market trends and position themselves advantageously in the market.

In conclusion, navigating the market amidst profit-taking bouts requires a cautious and proactive approach. By staying alert to potential reversals, diversifying portfolios, managing risk effectively, focusing on stock-specific opportunities, and staying informed about market and economic developments, investors can safeguard profits and capitalize on investment opportunities in a dynamic market environment.