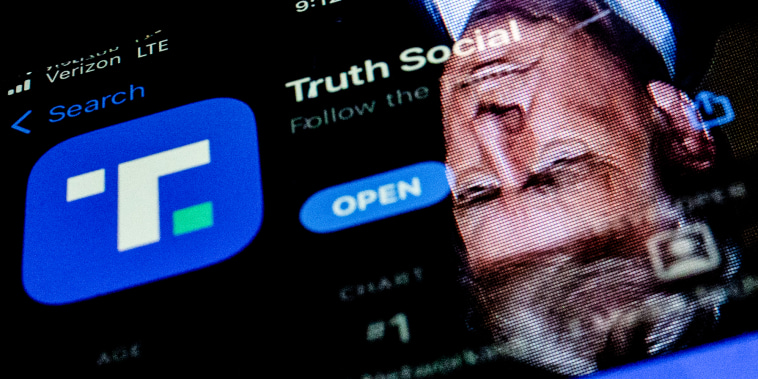

With the recent announcement of a media company filing to issue additional DJT stock, the market has seen a significant plunge in media shares related to the Trump brand. This move has sparked various discussions and debates in the financial world, shedding light on the intricate relationship between politics and business. Let’s delve deeper into the implications of this development and analyze its potential impact on the media landscape.

First and foremost, the decision to issue additional DJT stock by the media company signals a strategic move to capitalize on the Trump brand’s value and public interest. With Donald Trump being a polarizing figure in the political arena, his name carries substantial weight and recognition across various demographics. By expanding the availability of DJT stock, the company aims to attract investors who see potential in leveraging the Trump brand for financial gain.

However, despite the initial enthusiasm surrounding the issuance of additional DJT stock, the plummeting media shares suggest a more complex narrative at play. The market’s response to this announcement reflects a sense of uncertainty and skepticism regarding the long-term viability and stability of such investments. Investors are now questioning the sustainability of banking on a political figure’s brand, especially one as controversial and divisive as Donald Trump.

Moreover, the decline in media shares could also be attributed to inherent risks associated with political affiliations in the business world. The intertwining of politics and media has always been a delicate balance, with companies often walking a tightrope to maintain neutrality and credibility. Any perceived alignment with a specific political figure or ideology can alienate a significant portion of the audience, leading to financial repercussions and reputational damage.

Furthermore, the plummeting media shares may underscore a broader shift in consumer sentiment and preferences within the media landscape. In an era where authenticity, transparency, and accountability are increasingly valued by audiences, associations with politically charged personalities like Donald Trump can potentially deter viewership and engagement. This phenomenon highlights the evolving dynamics of media consumption and the need for companies to adapt to changing market trends.

In conclusion, the plunge in media shares following the announcement of issuing additional DJT stock by the media company serves as a compelling case study of the intricate interplay between politics, business, and the media landscape. This development underscores the complexities and challenges that arise when navigating political affiliations in the corporate world, emphasizing the importance of strategic foresight, market understanding, and consumer insights in shaping sustainable investments and business decisions. As the market continues to react and adapt to these changes, only time will tell the long-term implications of such entanglements on the media industry as a whole.