Rules-Based Money Management: Putting Trend Following to Work

In the world of investments, particularly in the realm of stocks, forex, and commodities trading, having a solid money management strategy is crucial for long-term success. One popular approach that has gained widespread attention and adoption is trend-following. Trend following is a strategy that seeks to capture gains by detecting and exploiting established trends in financial markets. In this article, we will delve into the intricacies of trend following and explore how it can be effectively deployed as part of a rules-based money management system.

Trend following as a strategy revolves around the concept of riding the momentum of a prevailing trend in the markets. This involves identifying assets that are experiencing sustained price movements in a particular direction and then entering trades to profit from these trends. One of the key principles of trend following is the idea that markets exhibit persistent trends over time, which can be capitalized on by traders who have the discipline to follow these trends and let their profits run.

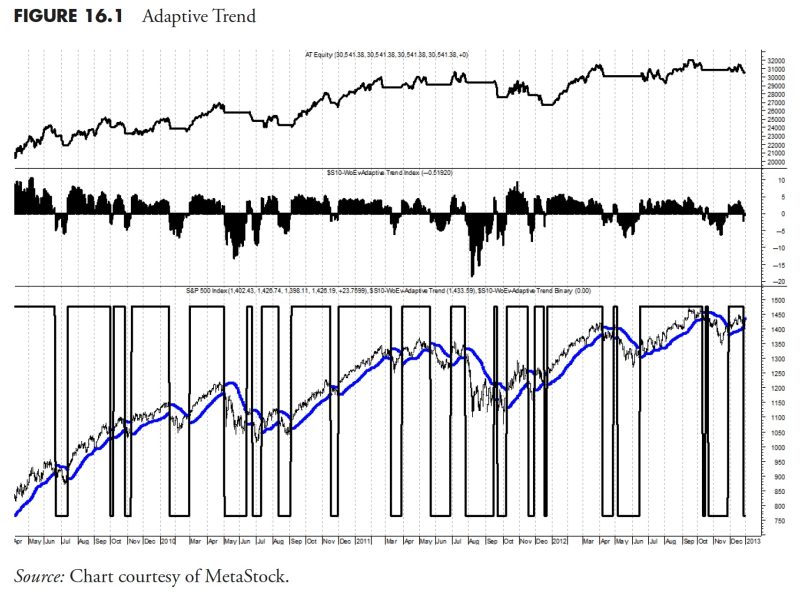

Central to successful trend following is the use of systematic rules and indicators to guide trading decisions. By employing a set of predefined rules and parameters, traders can avoid emotional decision-making and ensure consistency in their approach. These rules may include entry and exit criteria based on technical indicators such as moving averages, trendlines, or momentum oscillators. Additionally, risk management rules, such as setting stop-loss levels and position sizing based on volatility metrics, are essential components of a robust trend-following strategy.

Implementing trend following within a rules-based money management framework offers several advantages. Firstly, it provides a clear and objective methodology for identifying and participating in trends, eliminating the ambiguity and subjectivity often associated with discretionary trading. By following predefined rules, traders can avoid impulsive decisions driven by fear or greed, thus enhancing discipline and consistency in their trading approach.

Furthermore, incorporating trend following into a money management system helps to mitigate the impact of adverse market conditions. By riding established trends, traders can benefit from the momentum and directional bias of markets, even during periods of increased volatility or uncertainty. Additionally, employing risk management techniques such as trailing stop-loss orders can help protect profits and limit potential losses, thereby preserving capital and reducing drawdowns.

It is important to note that while trend following can be a powerful tool in a trader’s arsenal, it is not without its limitations. Markets can undergo periods of consolidation or whipsaw movements that can pose challenges for trend followers. It is crucial for traders to adapt their strategies to changing market conditions and be prepared to exit losing positions swiftly when trends reverse.

In conclusion, trend following can be a valuable component of a rules-based money management system for traders looking to capture gains from established market trends. By incorporating systematic rules and risk management techniques, traders can build a disciplined and consistent approach to trading that enhances their chances of long-term success. While trend following is not a guarantee of profits, when implemented effectively, it can help traders navigate the complexities of financial markets and achieve their investment objectives.