The Hindenburg Omen: A Technical Analysis Tool with Market Implications

The Hindenburg Omen, a technical analysis tool named after the famous Hindenburg disaster of 1937, has gained attention in the financial world as an indicator of potential market turbulence. This signal occurs when a series of market conditions align, suggesting increased uncertainty and the possibility of a market downturn. While not infallible, the Hindenburg Omen has been associated with significant market corrections in the past, making it a point of interest for investors and traders alike.

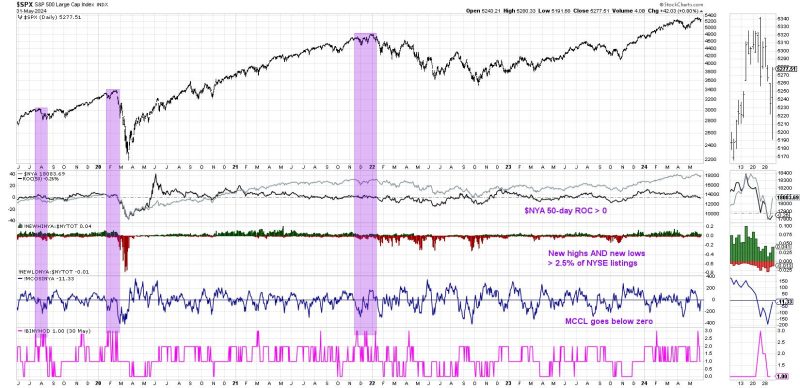

The criteria for the Hindenburg Omen include a substantial number of new highs and new lows in the market, occurring simultaneously, typically on the New York Stock Exchange. This divergence between new highs and new lows suggests underlying market weakness and indecision among investors. Additionally, the omen considers factors such as market breadth, volume, and the proximity of the 52-week highs and lows, providing a comprehensive view of market sentiment.

One of the key features of the Hindenburg Omen is its ability to identify initial sell signals in the market. When the criteria are met, it serves as a warning sign for potential market volatility and downside risk. While not a guarantee of a market crash, the Hindenburg Omen can act as a cautionary signal for investors to reassess their portfolios and risk exposure.

The implications of the Hindenburg Omen go beyond just a technical signal. Market participants often pay close attention to such indicators as they can influence trading decisions and overall market sentiment. The mere presence of the omen can lead to increased nervousness and heightened volatility as market participants react to the potential downside risk.

It is important to note that while the Hindenburg Omen has been associated with market corrections in the past, it is not foolproof. Markets are influenced by a myriad of factors, including economic data, geopolitical events, and investor sentiment, making it challenging to predict with certainty the direction of stock prices. As with any technical analysis tool, the Hindenburg Omen should be used in conjunction with other indicators and factors to make informed investment decisions.

In conclusion, the Hindenburg Omen serves as a valuable tool in the arsenal of technical analysts and traders, providing an early warning signal of potential market turbulence. While not without its limitations, the omen’s ability to identify initial sell signals can aid investors in navigating volatile market conditions and making informed decisions. By understanding and incorporating the Hindenburg Omen into their analysis, market participants can better prepare for market downturns and manage risk effectively.